Form 990 EZ Short Form Return of Organization Exempt from Income Tax 2022

What is the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

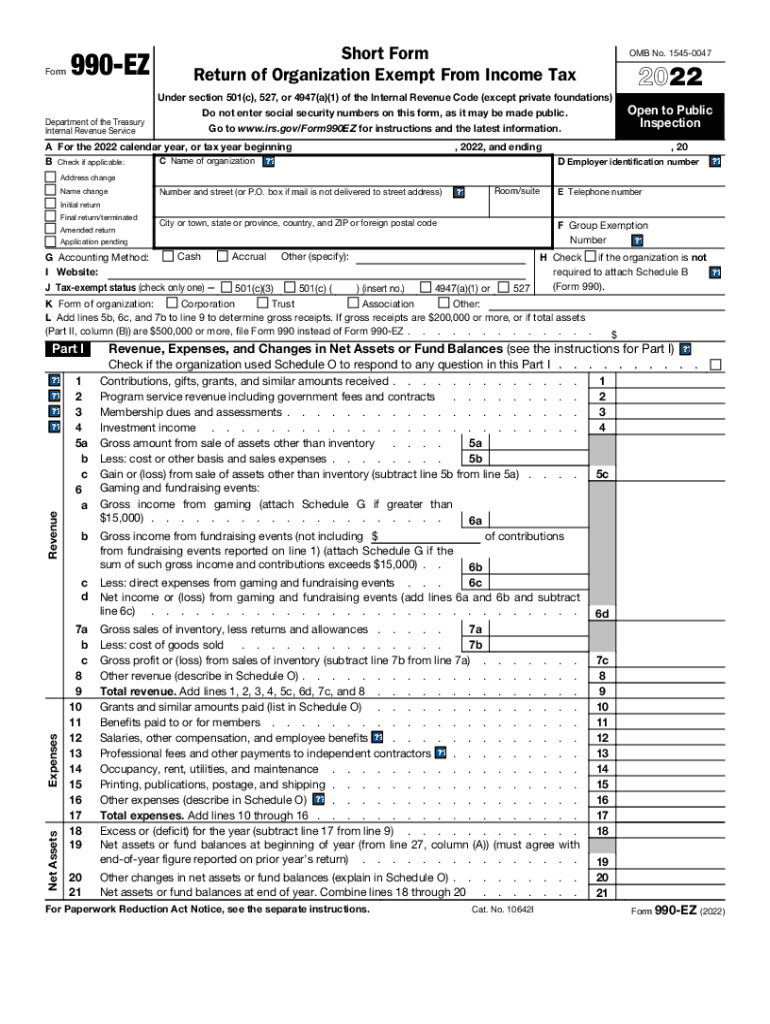

The Form 990 EZ is a streamlined version of the standard Form 990, designed for organizations that are exempt from federal income tax under section 501(c) of the Internal Revenue Code. This form is specifically intended for smaller tax-exempt organizations, typically those with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. It provides a simplified way for these organizations to report their financial activities, ensuring compliance with IRS requirements while minimizing the burden of paperwork.

How to use the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

Using the Form 990 EZ involves several steps to ensure accurate reporting of your organization’s financial information. Begin by gathering all necessary financial records, including income statements and balance sheets. The form requires details about your organization’s mission, programs, and financial activities over the fiscal year. After completing the form, review it for accuracy and ensure that all required schedules are attached. Finally, submit the form to the IRS by the appropriate deadline, which is typically the fifteenth day of the fifth month after the end of your organization's fiscal year.

Steps to complete the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

Completing the Form 990 EZ involves a series of methodical steps:

- Gather financial documents, including income and expense statements.

- Fill out the basic information section, including the organization’s name, address, and Employer Identification Number (EIN).

- Report revenue and expenses accurately, ensuring all figures align with your financial records.

- Complete the Schedule A, if applicable, to provide additional information about your organization’s public charity status.

- Review the completed form for accuracy, ensuring all required signatures are included.

- Submit the form electronically or via mail to the IRS by the filing deadline.

Legal use of the Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

The Form 990 EZ is legally recognized as a formal report to the IRS, fulfilling the requirement for tax-exempt organizations to disclose their financial activities. Proper completion and timely submission of this form help maintain compliance with federal regulations. It is important to ensure that all information provided is accurate and truthful, as any discrepancies could lead to penalties or loss of tax-exempt status. Organizations must retain copies of their submitted forms and supporting documents for their records.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 EZ to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month following the end of the organization’s fiscal year. For example, if your fiscal year ends on December thirty-first, the form would be due by May fifteenth of the following year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can apply for an automatic six-month extension by filing Form 8868, but this does not extend the time for payment of any taxes owed.

Eligibility Criteria

To qualify for using the Form 990 EZ, an organization must meet specific eligibility criteria. Primarily, it should be recognized as tax-exempt under section 501(c) of the Internal Revenue Code. Additionally, the organization’s gross receipts must be less than two hundred fifty thousand dollars and total assets must be under five hundred thousand dollars at the end of the tax year. Organizations that do not meet these thresholds are required to file the longer Form 990. It is essential for organizations to assess their eligibility annually to ensure compliance with IRS regulations.

Quick guide on how to complete 2022 form 990 ez short form return of organization exempt from income tax

Effortlessly Prepare Form 990 EZ Short Form Return Of Organization Exempt From Income Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 990 EZ Short Form Return Of Organization Exempt From Income Tax on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax Without Stress

- Obtain Form 990 EZ Short Form Return Of Organization Exempt From Income Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 990 EZ Short Form Return Of Organization Exempt From Income Tax to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 990 ez short form return of organization exempt from income tax

Create this form in 5 minutes!

People also ask

-

What is the 990 ez form and why do I need it?

The 990 ez form is a simplified filing option for tax-exempt organizations with gross receipts below a certain threshold. It is designed to ease the burden of compliance while ensuring transparency. Filing the 990 ez helps maintain your organization's tax-exempt status and informs the public about your financial activities.

-

How does airSlate SignNow facilitate the 990 ez filing process?

airSlate SignNow simplifies the 990 ez filing process by allowing users to electronically fill out, review, and eSign their documents. This intuitive platform provides guidance and templates specific to the 990 ez requirements, ensuring accuracy and compliance. Additionally, it streamlines document storage and sharing, making audits easier.

-

What are the key features of airSlate SignNow for 990 ez users?

Key features of airSlate SignNow for 990 ez users include an easy-to-use interface, secure document eSigning, and real-time collaboration tools. The platform ensures that your 990 ez documents are well-organized and accessible, with automated reminders for filing deadlines. These features reduce administrative burdens and increase efficiency.

-

What are the benefits of using airSlate SignNow for 990 ez compliance?

Using airSlate SignNow for 990 ez compliance brings numerous benefits, including enhanced speed and accuracy in document handling. The platform's compliance checks help avoid common errors that can lead to filing penalties. Furthermore, you can keep your data secure with airSlate's robust encryption and security measures.

-

Is airSlate SignNow cost-effective for small organizations filing the 990 ez?

Yes, airSlate SignNow is designed to be cost-effective, especially for small organizations needing to file the 990 ez. With flexible pricing plans, users can access robust eSigning capabilities without straining their budgets. Investing in airSlate SignNow ultimately saves money on paper, printing, and mailing costs.

-

Can I integrate airSlate SignNow with other software for managing 990 ez submissions?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software that can assist with 990 ez submissions. This integration allows you to pull in data directly, reducing manual entry errors and streamlining your filing process. Check out the list of supported integrations on our website.

-

How do I ensure my 990 ez submissions are secure with airSlate SignNow?

airSlate SignNow prioritizes the security of your 990 ez submissions through advanced encryption and secure cloud storage. Our platform also complies with eSign regulations, ensuring your documents are legally binding and protected. Regular security audits and updates further guarantee that your sensitive information remains safe.

Get more for Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- Ohio release form

- Quitclaim deed from individual to llc ohio form

- Ohio llc 497322235 form

- Ohio limited 497322236 form

- Request lien form 497322238

- Ohio quitclaim deed 497322239 form

- General warranty deed from husband and wife to corporation ohio form

- Limited warranty deed from husband and wife to corporation ohio form

Find out other Form 990 EZ Short Form Return Of Organization Exempt From Income Tax

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT